Protection distribution choices

Combined with a compelling game plan, the right distribution channel can get you a good reinsurance deal and maximize your chance of protection success. It affects the work you need to do on distribution support, underwriting and analytics. It can help you avoid the challenger cage.

Part of a series on protection distribution.

- Distribution choices Choosing the right channel

- Protection term growth 2015-2020. Split by advisory status

- The distribution sandwich. To be written

- What intermediaries want. To be written

- Distribution quality management. To be written

- Execution-only protection. The aggregator-busting approach

- The advice debate. To be written

Article scope

Distribution is important to any business. The choices of protection distribution channel has short- and long-term implications. Decisions at outset may restrict future scalability.

We’ll first cover protection volumes for each channel. Thanks to Swiss Re’s TermWatch this is largely factual and points the way to three main channel options.

We’ll review challengers’ distribution choices. Mainly this is IFA+ and direct distribution, but we highlight one instech which has chosen the aggregator route to market.

Thanks to Ruth Gilbert of Insuring Change who reviewed this article. The IFA section now has data emphasizing that protection “IFAs” are not just traditional investment advisers. Hence IFA+.

Finally we briefly look at distribution alternatives. We don’t find them convincing.

Volumes by channel over time

Let’s look at recent protection volumes.

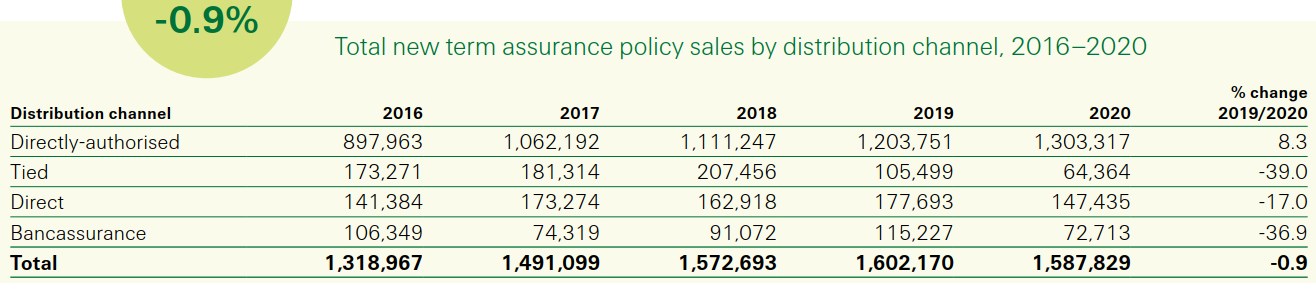

Term assurance volumes: 2016-20

Source: Swiss Re’s TermWatch 2021 - page 22

Source: Swiss Re’s TermWatch 2021 - page 22

Term assurance includes life term and accelerated CIC, but excludes stand alone CIC and Income Protection which get separate coverage in TermWatch.

Aside: the directly-authorised (DA) category is explored further below, but includes IFA firms and networks directly-authorised by the FCA as well as Appointed Representatives and Registered Individuals who carry out business on behalf of the DA firm/network.

We saw Covid-related declines in 2020, although DA sales held up well, with tele-sales probably growing strongly. Over the 5-year period the bank channel sales have been patchy and tied sales have significantly declined, but this has been more than made up by DA growth.

The numbers above include advised and non-advised business. The non-advised share has grown over time and it’s currently a matter of intense debate, led by Lifesearch’s Tom Baigrie.

Volumes by channel in 2020

| Channel | Policies sold (2020) | % |

| IFA+ | 1,131,315 | 71.2 |

| Direct | 147,435 | 9.3 |

| Aggregator | 92,304 | 5.8 |

| Exec only | 66,163 | 4.2 |

| Bancassurance | 72,713 | 4.6 |

| Tied | 64,364 | 4.1 |

| Other | 13,535 | 0.9 |

| Total | 1,587,829 | 100.0 |

Source: Swiss Re’s TermWatch 2021

While we could explore the execution-only and “other” category further, we can see that there are three main channels open to most challengers - IFA+, direct and aggregators:

| Channel | Policies sold (2020) | % |

| IFA+ | 1,131,315 | 71.2 |

| Direct | 147,435 | 9.3 |

| Aggregator | 92,304 | 5.8 |

| Other | 216,775 | 13.7 |

| Total | 1,587,829 | 100.0 |

Source: Swiss Re’s TermWatch 2021

Splitting the IFA+ channel

If we ignore over 50s guaranteed acceptance whole life plans, protection insurance distribution is dominated by advisers, brokers and specialist intermediaries.

Source: Let the Adviser Advise - Alan Lakey - CIExpert

In the table below, the FCA’s pure protection sales include all forms of critical illness and income protection, but not life term business - despite the FCA including life cover in pure protection. Odd; we think it’s some messy combination of complaint tracking and ICOB regulation.

We adopt the Lakey terminology; the first three rows are the IFA+ channel. It’s worth pursuing this split, as each has different needs e.g. read RGAX’s thoughts on mortgage brokers.

Percentage of pure protection sales by channel

| Distributor type | 2016 | 2017 | 2018 | 2019 |

| Personal Investment - “advisers” | 29.7 | 27.1 | 25.5 | 23.3 |

| Mortgage Business - “brokers” | 29.0 | 28.8 | 31.6 | 32.4 |

| Gen Ins intermediary - “specialists” | 19.0 | 20.4 | 24.0 | 28.3 |

| Bank & Building Soc | 5.1 | 4.9 | 3.4 | 2.3 |

| Life Insurer | 5.4 | 10.3 | 9.0 | 6.3 |

| Other Insurer (1) | 1.4 | 1.1 | 0.9 | 0.6 |

| Other (2) | 10.5 | 7.2 | 5.5 | 6.8 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 |

Source: FCA annual sales data - links to a spreadsheet

Notes

- General and composite insurers and Lloyds business.

- Believed to include price comparison (aggregator) sites.

Consistent with results on advice versus non-advice, the personal investment (generally advised) share has fallen, while the specialist share (often non-advised) has grown over time.

Choices challengers made

A key decision for a protection challenger is the channel through which to distribute its products. The obvious choices are the IFA+ channel (as defined earlier), aggregators and direct distribution.

To set out the choices challengers have made I simply give a non-exhaustive list, split by channel. I’ll be aiming to give a little more coverage in a separate article.

IFA+ channel

We note Lakey’s split and the non-advised share of around 35% in 2020. The IFA+ channel is by far the largest, but challengers have rarely found the going easy. The channel makes substantial demands of participant insurers, in terms of pricing, underwriting and analytics.

Protection challengers: IFA+ market

Here’s a list of entrants over the last c20 years:

| Challenger | Launched | Status |

| Bright Grey | 2003 | Became Royal London in 2016. |

| Royal Liver | 2004 | Closed to new business in 2010. |

| PruProtect | 2007 | JV with Vitality. Now purely Vitality. |

| Fortis | 2008 | Became Ageas (2010). Ageas Protect sold to AIG (2015). |

| Vitality | 2007/2014 | 5th in CIC market (2020). |

| Guardian | 2018 | Not close to top 5 (2020). |

Again, for each provider I aim to give a little more coverage in a separate article.

Direct channel

Direct distribution might seem the obvious choice for the 21st century and has been the primary distribution channel for most challengers. The channel is less demanding in terms of pricing, underwriting and analytics, but sourcing business and getting to scale is not easy.

Protection challengers: direct market

Here’s a list of entrants over the last c20 years:

| Challenger | Launched | Status |

| Direct Line | 1995 | Closed 2011. Now distributes AIG products. |

| Easylife | 2000 | Closed. |

| Virgin Money | 2006 | Scottish Widows in 2006 and Beagle Street since 2017. |

| Smart Insurance | 2012 | Part of Neilson FS a large but currently loss making group. |

| Cignpost | 2015 | Open. |

| Cavendish Life | 2016 | Open - direct-to-consumer and white labelling. |

| Different Life | 2017 | Open. |

| Sherpa Life | 2017 | Closed to new business in 2020. |

| Dead Happy | 2019 | Open. Some are very enthused. Some perhaps less so. |

| Reviti | 2019 | Closed in 2022. |

| Spring | 2020 | Closed in 2022. |

| Bequest | 2021 | Open. |

| Bluezone | 2022? | Interesting, but not yet formally launched. |

I have used launch year rather than the year the company was founded, which was sometimes much earlier e.g. Dead Happy was founded in 2013 - confirmed by their filing of accounts.

Aggregator channel

While smaller than the other main channels, aggregators may seem an attractive choice; their sourcing of business offers control over costs. Market monitoring and pricing are crucial, but distribution analytics can be postponed. Underwriting can be developed at a slower pace.

This may sound tempting, but only Beagle Street has chosen this route - I omit non-challengers already in the IFA+ market or companies which simply distribute others’ products.

Beagle Street hasn’t (yet) used their aggregator experience as a springboard to expansion. Perhaps this will change now that Markerstudy has acquired BGL’s insurance arm.

Finally the opportunities this channel offers will depend on the competitiveness of pricing: this has been more demanding than the IFA+ market at times. Much more in Goldilocks Pricing 2.

Distribution alternatives

Cross selling

Several potential challengers have (or have acquired) significant inforce books. They might use these to experiment with and sell protection products. While it must be good news to have access to potential customers, there are reasons that I do not find this convincing as a “Plan A”.

It won’t get you to scale. My expectation is that a challenger using this strategy will exhaust its back book all-too-rapidly. Let’s suppose you can write 5% of the book as protection policies - a good result. Will you gain 20 “replacement” non-protection customers as you put a protection policy on risk?

It may build you a cage. Work done in any non-IFA+ channel can easily (if not necessarily) become replacement activity for acquiring the skills essential to scaling via the IFA+ market.

Cross selling could nonetheless be a good supplemental strategy, so long as you bear in mind its limitations e.g. you won’t be testing out your agent management skills and systems.

Partnerships

This has been mentioned to me by a Friendly Society which thought it could identify partners with gaps in their product ranges and who would share a similar ethos. I’m unconvinced.

The partnerships generating any real volume are with the largest protection players e.g. L&G, Royal London, Aviva and AIG. Hard commission balances softer items such as shared values.

Further protection products can be a sideline and struggle for airtime against mortgages, other financial products or retail sales. Distribution partners may over-promise and under-deliver.

A challenger would certainly not “own” the customer in this distribution and you may need a powerful brand. A supplementary strategy at best, and probably unattainable for most challengers.

Being a licence provider

This is a strategy available to a challenger insurer or Friendly Society, but not to an instech which, by my definition, holds no insurance licence.

Existing players in this space include Scottish Friendly, iptiQ and Covea - though a small prize awaits anyone who can point to this on Covea’s website. Less well known is that AIG, Royal London and Shepherds Friendly have on occasion rented their licence.

While possible, most licence providers would not want to (effectively) compete against reinsurers by retaining risk; this also slows down the process significantly as we found to our cost. So a challenger would end up competing on fee levels against incumbents.

A licence holder bears ultimate responsibility and potentially reputational risk. Specifically the provider must oversee how risk and reward is shared between them, the instech and the reinsurer in normal and extreme circumstances.

Contracts may hold you responsible for more than you intended.

Conclusion: tune in to the right channel

Choosing the right distribution channel is the first part of a compelling game plan which maximizes your chance of a good reinsurance deal, a robust business case to launch and ultimate success.

Choosing the wrong channel, especially without an explicit plan to develop core protection competencies, can lead to the challenger cage, an inability to scale and disappointment.