The UK’s first instech?

There have been many instech launches. Some (e.g. Reviti) closed to new business, some (e.g. Sherpa Life) morphed into technology providers while others (e.g. Beagle Street) are still with us.

But before there was Bequest, Dead Happy or even Beagle Street there was Easylife.

- Arrivals and departures. A history of challengers.

- A challenger game plan. Improving your odds.

- Challenger cages. Why scaling up is hard.

- 3 Premiership moats. Which, if any, are real?

- Swiss Life's Solutions. A giant leap in 18 months.

- Easylife Protection. The UK's first instech?

- They shook protection. A tale of two companies.

- Happy April 1st. Self Assurance returns!

Disclosure: Arrivals and departures is based on research and interviews. The challenger game plan and the challenger’s cage result from personal experience: employment (articles 4-7) and observations from my consulting engagements, several of which have been with challengers.

Easylife Protection

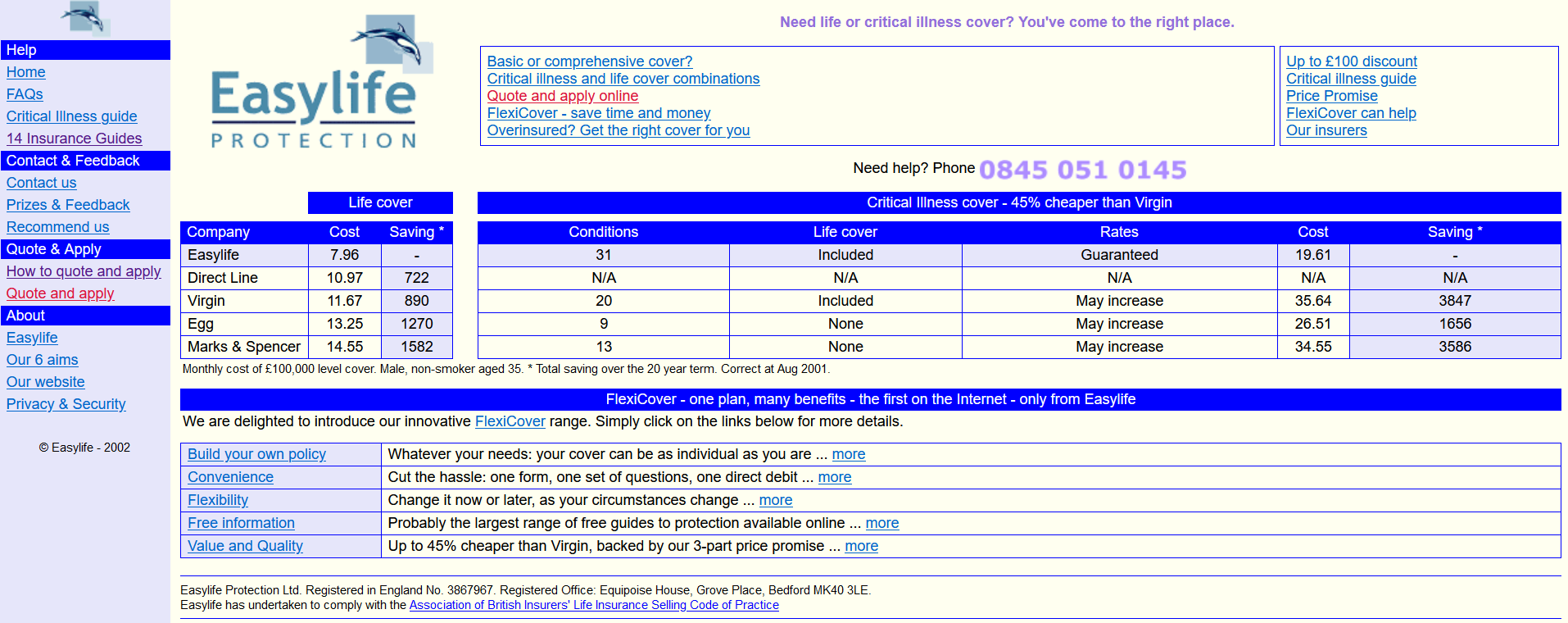

Conceived in 2000 by an accountant and actuary, was Easylife Protection the first UK’s instech?

Source: The Wayback Machine. Also from that time, remember Permanent and MIMI?

What we did

Easylife carried out many insurer functions: administration (even down to AUDDIS direct debits), product design, literature, reinsurance, IT systems and more.

Other areas such as the insurance licence provision and any (manual) underwriting were outsourced. Easylife’s overall aim was to thereby speed up insurance processes.

This article recounts what happened, warts and all. We look at what was delivered and the positive results, but also at what wasn’t so good. We draw out lessons.

Sources of pride

In a UK first(*) an online menu range – life and critical illness (CIC) on a level, decreasing or FIB basis – was designed and implemented in months: one policy went ahead with 5 benefits.

Backing the online menu quotes was a fully online application process: reflexive questions, light e-underwriting, backed with fully outsourced manual underwriting.

Another UK first(*) in 2001: a fully online CIC sale, with a 140K claim 15+ years later.

(*) Please let us know if you know better.

Business model and funding

Easylife split its protection offering into components, outsourcing areas where we lacked enough expertise or regulatory status, while retaining those we were confident we could personally deliver.

As noted, results included delivery of an online menu-based quotes system, with elementary underwriting rules supported by the reinsurer, in just a few months.

A key difference to many current instech firms was that Easylife focused on just two protection intermediaries. In that respect Easylife was like a tiny version of Guardian, although Easylife morphed into a direct-to-consumer (D2C) operation.

Funded by its two founders, at D2C stage Easylife ran with zero full-time employees.

Distribution

Easylife was too concentrated. The two intermediaries knew their power and demanded 180% LAUTRO in a market where 155% was the norm. Aggregator distribution did not yet exist.

Retail premiums also dropped by 15% in a year, without any reduction in (our) reinsurance terms.

Why did Easylife fold?

Around 2002 the licence provider, Criterion, facing general insurance challenges, changed business model and CEO. Criterion withdrew their licence, resulting in Easylife’s closure to new business.

Looking back, Criterion’s issues were evident earlier. Literature sign off was painfully slow, despite it being a near copy of others’, while 100% reinsurance was re-worked as a 75% quota share.

Lessons learned

No surprises here: choose your distribution and partners wisely.

Distribution and channels: easier than in 2000

Many instechs start as direct-to-consumer (D2C) offerings. Our experience was (and remains) that a pure D2C strategy struggles to generate volume cost-effectively.

We spent little and, with zero employees, were hugely profitable. But without volume this was academic. People like to compare prices, so aggregators or intermediary channels might be preferred.

Lessons:

- For D2C consider aggregator distribution, if the pricing works.

- For intermediary channels make sure you’re diversified.

Licence provider: easier than in 2000

Most instechs rent a licence. Today there is much more choice over licence providers; Scottish Friendly, Covéa, iptiQ and Shepherds Friendly have provided licenses in recent years.

Lesson: make sure of the licence provider’s position, especially on turnaround times and constraints they can impose on a challenger’s business.

Reinsurance: harder than in 2000

Back in 2000 we approached two reinsurers and got engagement and indeed rates from both. We had no complaints, but challengers are likely to find it harder today.

Today, reinsurers are more focused on core business. Challenger failures have sometimes meant reinsurer losses and few reinsurers have been repaid for their time.

Instechs often have people who are really smart, but lack enough domain experience.

Source: Unnamed reinsurer, private conversation

In principle a challenger might secure meetings with the whole market - say seven reinsurers (they always want to know what’s going on of course!) Of these perhaps four will give a serious hearing, given their public and previous positions.

In practice it seems that most recent challengers have been backed by one or two reinsurers, with Gen Re often publicly stated as the reinsurer e.g. for Bequest, Dead Happy and Sherpa.

Lesson: a reinsurer discussion is like using up one of your “lives”. Have plenty of expertise before visiting. This is a lesson confirmed by our relatively positive Easylife experience, but also from observing instechs and challengers since.

Where next?

Further lessons can be learned from other challengers who have arrived and (sometimes) departed. These and my personal experiences have informed my challenger game plan.