Protection: Goldilocks Pricing - Q4 2020 market research

The Goldilocks Pricing report investigates market prices for guaranteed rate individual protection business, based on over 900 single life quotes from the aggregator and IFA channels.

The scope is:

- Life cover in the aggregator market. We examine CompareTheMarket (CTM) and MoneySuperMarket (MSM). Recently sold Go Compare and Confused are out of scope.

- Critical Illness Cover (CIC) in the aggregator market. CTM only.

- Life cover in the IFA market. Abbreviated treatment.

For each of 1-3 we ask three questions:

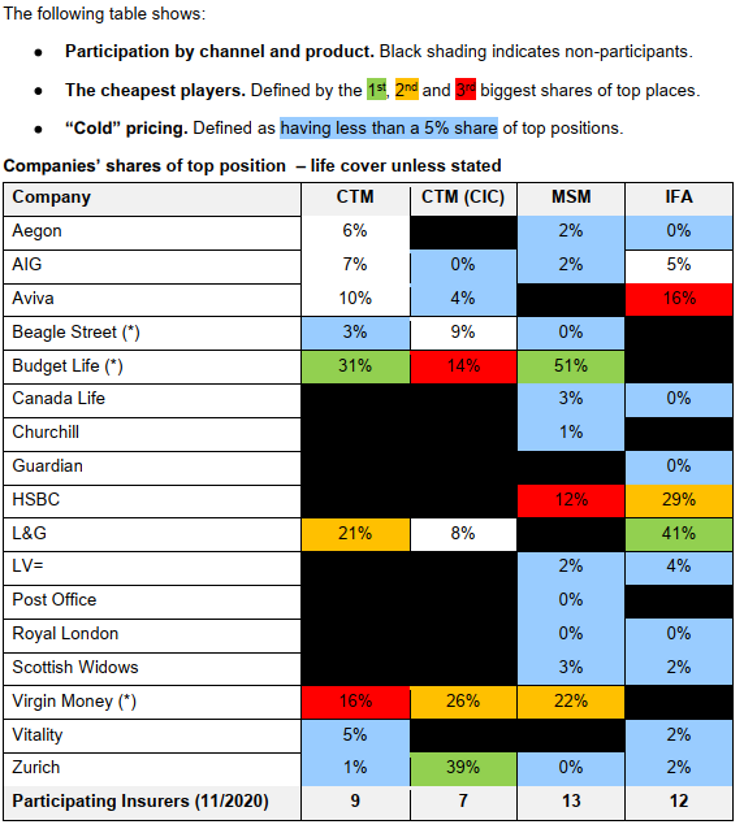

- Who’s top? We find the companies quoting the cheapest price, splitting the results by distribution channel, product (level and decreasing term) and smoker status.

- Who’s too cold? Some companies are rarely top. Are they “there or thereabouts” or are they consistently off the pace? How often do they occupy a top 3 position?

- Who’s too hot? To what extent do top position companies undercut their lower ranked peers? Some companies are consistently “too hot” – they leave significant money on the table.

Goldilocks Pricing: summary

The report (and this summary) uses the abbreviation BGL3 for the group of three companies Beagle Street, Budget Life and Virgin Money; the pricing for all three is carried out by Beagle Street.

A few things surprised me here:

- AIG seems relatively uncompetitive, despite being a big IFA market player.

- The position of Royal London (ditto) is even more surprising.

- Aviva’s non-competitiveness (and Vitality’s non-show) for CTM CIC.

Better known are that:

- The BGL3 dominate in the aggregator channels: just add Budget and Virgin’s 1st positions.

- Aegon, Canada Life, Guardian, LV=, Vitality and Zurich do not have price-competitive life cover in the IFA market, and this carries over into the aggregators.

- Zurich is particularly price competitive on CIC.

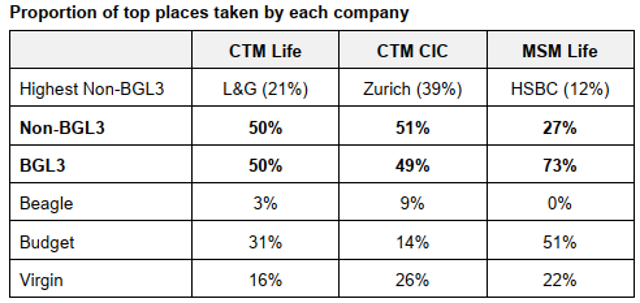

The dominance of the BGL3 in the aggregator channels is summarised by the following table. In its chosen channels the total BGL3 share of top places matches (CTM) or exceeds (MSM) the top places of all its competitors combined.

For comparison, the proportion of top places taken by the cheapest non-BGL3 company is shown. In the IFA life market L&G has a share of top positions of just over 40%. It does not participate on MSM. On CTM it quotes in less than 50% of cases.

The BGL3 do not play in the main part of the IFA market, where the insurers taking the highest proportion of top places are L&G (41%), HSBC (29%) and Aviva (16%).

While we have already suggested that some companies are struggling to compete on price, having a share of top positions of 50%+ might suggest some danger of over-heating – pricing being “too hot”.

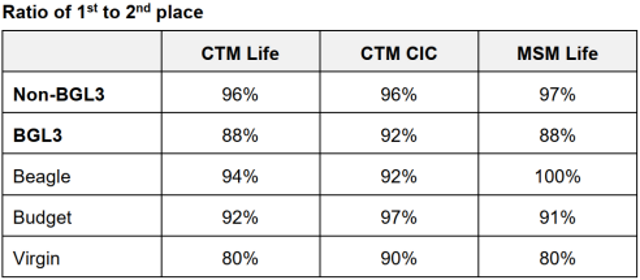

This report examines the concept further by looking at the ratio of 1st to 2nd position. Where top position is taken by one of the BGL3, the comparison is to the cheapest non-BGL3 provider.

Non-BGL3 taking top place undercut second place by 3%-4% on average. This applies for the IFA market and for (the investigated parts of) both life and CIC on aggregator portals.

The average BGL3 undercutting is double this in the CIC market and 3-4 times for life cover. Where Virgin is cheapest it undercuts by 20% rather than the non-BGL3 average of 3%-4%.