Protection distribution growth

The term (life and critical illness) market grew by more than 25% over 2016-2020. But this hides different fortunes for advisers and non-advisers.

Part of a series on protection distribution.

- Distribution choices Choosing the right channel

- Protection term growth 2015-2020. Split by advisory status

- The distribution sandwich. To be written

- What intermediaries want. To be written

- Distribution quality management. To be written

- Execution-only protection. The aggregator-busting approach

- The advice debate. To be written

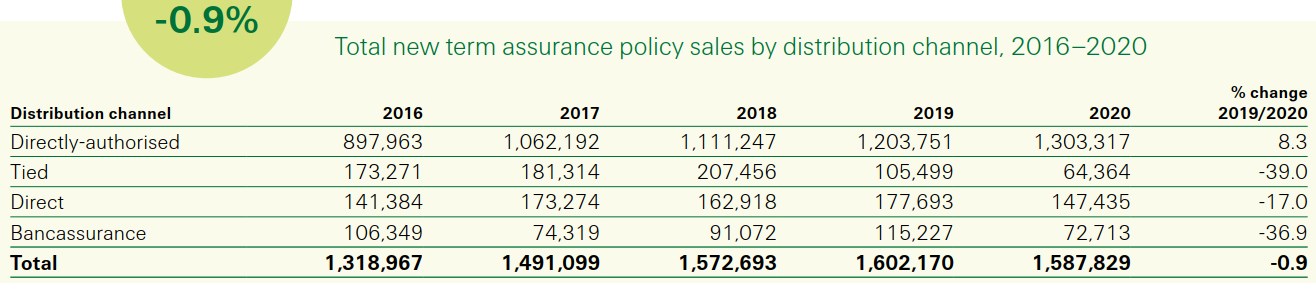

Channel volumes: 2016-2020

Protection volumes over this period (life term and accelerated CIC, but excluding stand alone CIC and Income Protection which get separate coverage in TermWatch):

Source: Swiss Re’s TermWatch 2021 - page 22

Source: Swiss Re’s TermWatch 2021 - page 22

We saw Covid-related declines in 2020, although directly-authorised (DA) sales held up well, with tele-sales probably growing strongly. Over the 5-year period the bank channel has declined and tied salesforces have collapsed, but this has been more than made up by DA growth.

Non-advised protection share

Based on 2020 sales of 1,587,829 term (life and accelerated CIC) policies:

| Product | Total | Non-advised | % |

| LTA | 790,335 | 394,544 | 49.9 |

| LTA with CI | 248,250 | 59,248 | 23.9 |

| DTA | 315,686 | 76,657 | 24.2 |

| DTA with CI | 179,134 | 18,398 | 10.3 |

| FIB | 29,540 | 2,307 | 7.9 |

| FIB with CI | 1,363 | 29 | 2.1 |

| Relevant life | 23,521 | 1,543 | 6.6 |

| Total | 1,587,829 | 552,726 | 34.8 |

The directly-authorised market is dominant and growing - see the first table - but over a third of protection policies are now sold without advice. The non-advised share has grown over time:

| Product | 2015 % | 2020 % |

| LTA | 30.6 | 49.9 |

| LTA with CI | 12.0 | 23.9 |

| DTA | 12.4 | 24.2 |

| DTA with CI | 4.4 | 10.3 |

Source: Protection Review - have our distribution predictions come true?

It could be that this is an under-estimate of the non-advised share, as the treatment of direct and execution-only business is not entirely clear to me.

Market growth by advisory status

Overall the term market has grown by just over a quarter and restricting to “the big 4” (and thereby missing out Relevant life and FIB) the growth is nearly 30%.

Overall term sales and growth: 2015-20

| Product | 2015 | 2020 | Growth (%) |

| LTA | 555,907 | 790,335 | 42.2 |

| LTA with CI | 203,945 | 248,250 | 21.7 |

| DTA | 225,582 | 315,686 | 39.9 |

| DTA with CI | 196,174 | 179,134 | -8.7 |

| All above | 1,181,608 | 1,533,405 | 29.8 |

| All term | 1,255,786 | 1,587,829 | 26.4 |

But this seemingly overall good news story hides very different fortunes:

- adviser sales have grown by under 4%

- non-adviser sales have grown by over 130%

Advised term sales and growth: 2015-20

| Product | 2015 | 2020 | Growth (%) |

| LTA | 385,799 | 395,958 | 2.6 |

| LTA with CI | 179,472 | 188,918 | 5.3 |

| DTA | 197,610 | 239,290 | 21.1 |

| DTA with CI | 187,542 | 160,683 | -14.3 |

| All above | x,950,423 | x,984,849 | 3.6 |

Non-advised term sales and growth: 2015-20

| Product | 2015 | 2020 | Growth(%) |

| LTA | 170,108 | 394,377 | 131.8 |

| LTA with CI | 24,473 | 59,332 | 142.4 |

| DTA | 27,972 | 76,396 | 173.1 |

| DTA with CI | 8,632 | 18,451 | 113.8 |

| All above | x,231,185 | x,548,556 | 137.3 |

Bottom line: assuming no leakage, without non-advisers the market would have grown at less than 1% p.a. Where does that leave the advice versus non-advice debate?