IR35: HMRC examples - Alan and Jemima

Please note: this article does not provide legal advice.

This article is part of a suite - a whirlwind tour to get up to speed on IR35:

- Background to assessment. HMRC's intent, guidance, CEST tool - plus legal cases.

- Making employment status decisions. The big picture on employment status decisions.

- HMRC examples - Alan and Jemima. Quite simple, no CEST.

- Examples - Chenguang and Kaye. Two examples, including using CEST.

- CEST criticisms and responses. CEST can be helpful, despite the criticisms.

- Gaming the system and pressure. HMRC are targeting these.

HMRC's thinking revealed

HMRC's twelve business entity tests were withdrawn in 2015, but unlike the Alan and Jemima example below explain HMRC's thinking. These more realistic examples are worth reading.

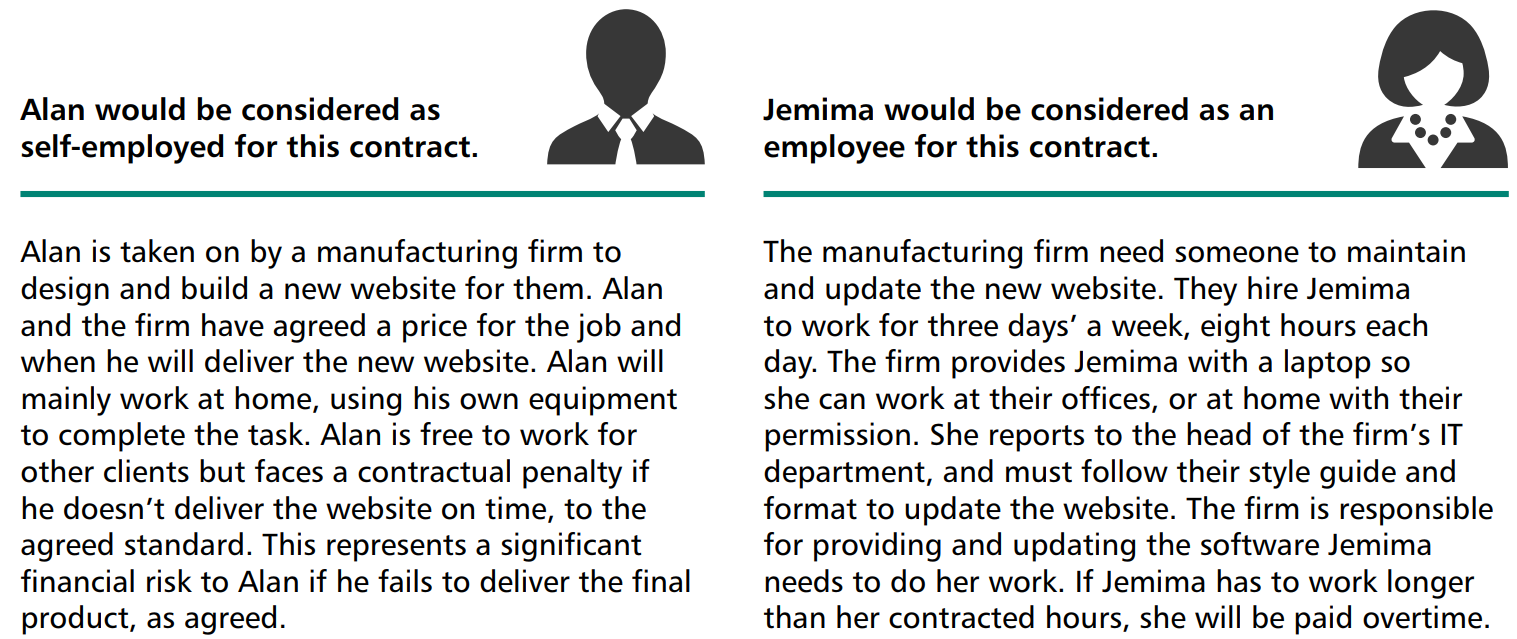

Alan and Jemima

There are few HMRC examples. Here’s one.

Source: HMRC IR35 factsheet - PDF

Source: HMRC IR35 factsheet - PDF

Alan is clearly not employed.

- He is is business on his own account - other clients, own equipment.

- He bears financial risk especially time-wise and perhaps quality.

A day contract might also entail financial risk. A hirer could terminate the contract - or let it end naturally - then say the work or end product was not of high enough quality.

Another example would be a decorator. Many work on on day rates, but would (in theory) have to put right poor work. The same might apply to light building and maintenance work.

Jemima is probably employed.

- Even though she could work for others.

- There is no indication that she bears financial risk.

Jemima could work for others, but the pointers are to employment in this position:

- specified hours

- hirer provides equipment (this could be for security reasons)

- reporting line (probably formal reporting rather than administration)

- paid overtime (this is very problematic)

I would expect that Jemima also has other employment rights e.g. holiday and pension.

Needing permission to work from home suggests an uncomfortable degree of control.

Having to follow a style guide is not so problematic; the reality is that Alan will also be under software and brand-related restrictions.

My conclusion

The key things at play here are having:- more expertise than your boss(!)

- the ability to work for other clients

- at least some freedom in working practices

HMRC may picture Jemima as having little expertise in (1) and being very constrained by (3).