Reinsurance structures and financial dynamics

- Why reinsurance works for big insurers. Magic1 for insurers.

- Reinsurance structures. Reinsurance and cashflows.

- The reinsurance DA VINCI code. Presenting your case to reinsurers.

Our planning article suggested that reinsurance was the most important building block in protection. Its effective use should be part of your planning.

The first part of this series noted that all but one of the UK’s twelve largest protection offices use substantial reinsurance. It examined why this makes sense.

We now turn to reinsurance structures and their financial impact on the insurer.

Simplifying assumptions

We assume that the proportion of business reinsured is 100% and remains constant over time. This simplifies the cashflows and the business model.

Net of reinsurance, the insurer has no exposure to claims. Not every reinsurer likes this, but this is the commercial reality for most of the UK market. Reinsurers seek to ensure that appropriate controls are in place to protect their interests.

The broader game

In the detail below don’t miss the big picture: since the late 1990s insurers have been managing volume, expenses and lapse experience, using reinsurance as well as the tools of price, product and process, especially underwriting.

Insurance versus reinsurance premiums

Retail premiums in the UK market are normally payable monthly. Premiums and benefits may increase in line with (e.g.) inflation or premiums in line with age. But we’ll assume level premiums.

Reinsurance premiums can follow a number of structures, explored below.

Structure 1: level reinsurance premiums

Original terms reinsurance, where the reinsurer matches the insurer’s rate, is largely historic. This hasn’t been popular for decades: it introduces a dependency on and unnecessary work for the reinsurer when an insurer changes its new business premium rates.

The most common arrangement today is for the level reinsurance premium to be combined with a day-1 commission from the reinsurer.

The reinsurer’s premium increases with its commission, but must be lower than the retail premium, limiting the commission.

After the insurance commission payment at time zero all the insurer’s net cashflows will be positive, even allowing its ongoing commission payments and expenses.

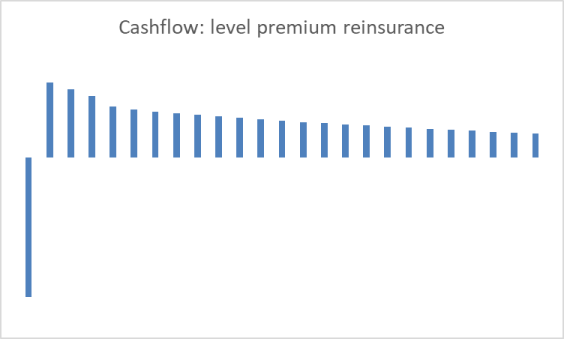

The no-scale minimalist diagram shows the cashflow shape over a 25-year term, moving from left to right. This shape matters, rather than the absolute amounts.

The negative cashflow reflects initial expenses and commission, reduced by month 2-12 positives. Initial commission is often over 200% of one annual premium.

The positives fall over time, reflecting lapses i.e. policyholders who stop paying premiums. Clearly the insurer makes more money the lower the lapses.

For completeness, other structures which provide no day-1 reinsurance commission are available, but are rare today:

- Lower nil-commission level reinsurance premiums.

- Reduced reinsurance payments for an initial period.

The cashflow profile will be similar, with adjustments for any lower reinsurance premiums in the first few years.

Structure 2: risk premiums

Risk premium rates depend on the initial age of the policyholder, the duration since outset and increase with attained age.

The risk premium structure is more complex than level reinsurance premiums: the reinsurance premium will in due course exceed the insurer’s premium, whereupon net cashflow turns negative.

The insurer needs to be mindful of this; the insurer will need to make provision for those negatives.

When cashflow turns negative the insurer would “prefer” the contract to lapse, releasing funds. Of course by then the insurer has little control over policyholder behaviour, and in any case would not dream of acting against their interests.

As noted above risk premium implies a more complex dynamic than level reinsurance premiums. We split this into level and decreasing benefits.

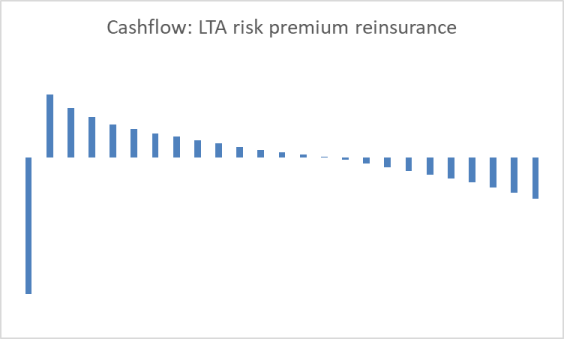

Risk premium reinsurance: LTA

We first look at level benefits (LTA).

The reinsurance premium rises, eventually exceeding the level retail premium. This is why the cashflow eventually turns negative in the diagram below.

Insurance regulations and prudence mean that insurers put up capital to eliminate the negatives.

Adjusting the cashflows for capital, we get to profit which, after month 1, is positive. The value of profits should be positive, unless the policy is priced as loss making.

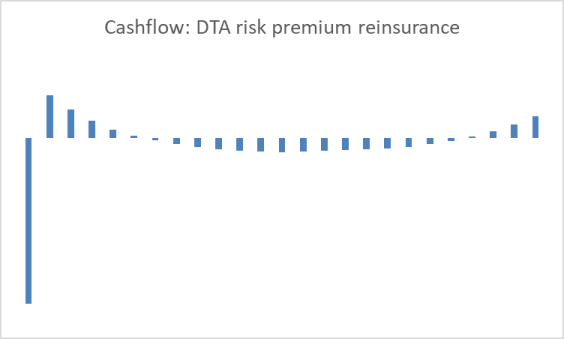

Risk premium reinsurance: DTA

Things can get more complex for decreasing term (DTA) business. In the diagram below the initial positives turn negative then back to positive.

What’s going on?

The increasing reinsurance premium rates are applied to a reducing benefit i.e. the sum assured. The product of the two is the reinsurance premium.

Initially the increasing reinsurance rate dominates, leading to the negative cashflows. But the reducing benefit eventually overcomes the increasing reinsurance rate. The reinsurance premiums reduce and net cashflow turns positive towards the end of the contract.

Risk premium and commission

Risk premium reinsurance makes no contribution to the insurer’s initial expenses and commission, so insurers sometimes enter into separate financing agreements.

Structure 3: financial reinsurance

Some companies make do without financial reinsurance. They may have no need for cash. Others prefer to convert some or all of the future positive cashflows into a single day-1 positive, though that may be tempered by the conversion terms on offer.

In short, financial reinsurance focuses on cash and capital management rather than risk transfer. This post examines only one simple type, abbreviated to financing.

Reinsurance financing

Sometimes the focus is on managing solvency, by doing a deal on an inforce book. At other times the focus will be on easing the strain of the insurer paying large amounts of day-1 commission on new business. This will be the focus here.

For level premium reinsurance, described earlier, repayments of any commission are implicit via a higher reinsurance premium which also pays for risk coverage. Reinsurance premiums stop when the policy lapses or claims.

In contrast, reinsurance financing is usually separate from the risk reinsurance. It may be provided by a different reinsurer, who advances cash which is repaid from free cashflow available on a tranche of the insurer’s business.

The cash advance is usually conservative and secured against a block of policies. Terms (LIBOR + bps) may seem attractive, but reflect that the reinsurer is taking a bond-like rather than equity-like risk.

Internal financing

For some insurers Solvency II provides an alternative to reinsurance financing. Solvency II’s best estimate liability (BEL) is be held against positive future outgo.

For a profitable contract the BEL at time zero should be negative. For level reinsurance premiums the BEL will remain negative throughout the contract, while for risk premium reinsurance the BEL will usually turn positive. Both are implied by previous diagrams.

Here’s the point. Companies which have existing business with an overall positive BEL can net off the negative new business BEL. In that sense profitable protection business can be cash generative, as pointed out in L&G’s Q4 2020 capital markets presentation.

Some protection specialists might not have a book of business with a materially positive BEL, so will need to look beyond Solvency II and to reinsurers.

In conclusion

Many protection insurers use 100% reinsurance. We looked at three structures and their impact on cashflow and, correspondingly, capital and profit emergence. But its really important not to forget the broader implications for insurers.

Let’s say you buy into the importance of reinsurance. An obvious challenge is how to positively present your case to potential reinsurers.

1 Reinsurance may not be real magic.