Presenting your case to reinsurers

- Why reinsurance works for big insurers. Magic1 for insurers.

- Reinsurance structures. Reinsurance and cashflows.

- The reinsurance DA VINCI code. Presenting your case to reinsurers.

Target audience

This post aims to appeal to UK companies who want to boost their individual protection presence:

- Friendly Societies and specialists. You focus on Income Protection or Child Trust Funds, but want to thrive in the 21st century. You probably have an insurance licence.

- Soon-to-launch challengers. You’re a brand or broker aiming to develop business and boost profits. You’ll probably use a third-party insurance licence.

Given reinsurer appetite, this post’s ideas can be applied beyond the UK; using the UK’s protection experience over the last 25 years is like being given free money.

Protection market participants

There are seven life reinsurers serving the UK market – in alphabetical order GenRe, Hannover Re, Munich Re, Pacific Life Re, RGA, SCOR and Swiss Re. Their clients are, for our purposes, life insurers offering individual protection products: life term, critical illness and income protection.

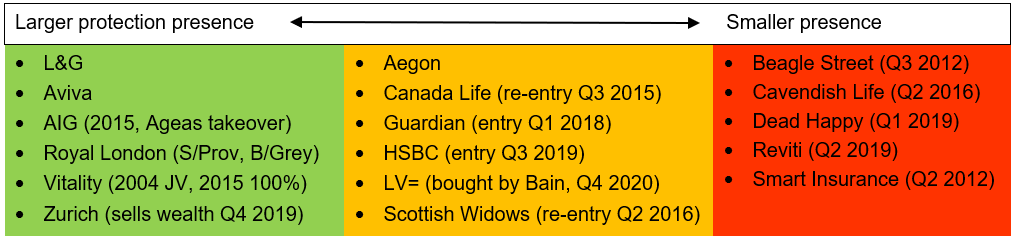

In the IFA market there are six large protection offices (AIG, Aviva, L&G, Royal London, Vitality and Zurich). The next six are much smaller. Beyond the IFA market things get interesting:

- Friendly Societies have a limited range of protection products - often only Income Protection, focused on blue collar occupations. They use IFAs and other intermediaries to distribute.

- Direct to consumer (D2C) brands. Beagle Street has grown via portals such as Compare the Market. Others such as DeadHappy and reviti are smaller and don’t use portals.

- Intermediaries. These include Smart Insurance (Neilson) and Cavendish Life.

A summary - excluding Friendly Societies, but giving dates - is given in the diagram. Beagle Street should probably be in the middle group, but is not in the main IFA market.

Source: Transformaction Q1 2021 work for a reinsurer. Except for L&G and Aviva insurers are set out in alphabetical order. Thanks to Ruth Gilbert of Insuring Change for helpful feedback.

Source: Transformaction Q1 2021 work for a reinsurer. Except for L&G and Aviva insurers are set out in alphabetical order. Thanks to Ruth Gilbert of Insuring Change for helpful feedback.

The D2C brands above use a third party insurance licence, typically Scottish Friendly Assurance. These are not the only D2C companies and I expect to see more use made of licence provision.

The reinsurers’ challenge

Should reinsurers focus or diversify?

Core business

To cover overheads and make a profit reinsurers need to take a share of business from the top six protection insurers - only Zurich currently uses little external reinsurance.

But the larger protection insurers are firmly focused on price, with regular tendering exercises. This sets up a classic winner’s curse scenario.

Outside the top six things might be slightly less competitive, but volumes are much lower.

Beyond the core

There are clearly risks with a pure core business focus; dropping a major client could easily mean a 50% drop in income and that risk recurs every re-tender. The insurer also clearly holds the balance of power, which is not to say they act inappropriately.

It therefore makes sense to look for diversification and growth elsewhere. But this comes with its own challenge: often companies which are either entirely new to the market or are looking to grow rapidly (but profitably!) need reinsurer support.

A reinsurer with sufficient time and expertise to offer support may still lack appetite; most major launches and re-launches have had limited success and, consequently, reinsurers’ work has often been poorly rewarded. AIG and Vitality are success stories, both a result of previous entities.

Getting reinsurance traction

How does a challenger get access to reinsurance magic?

Here are some pointers for those looking to launch or grow. First some mistakes to avoid and then some positives to achieve.

Mistakes: don’t be naïve, greedy or needy

Mistake: assuming reinsurers will necessarily give you terms. Challengers and start-ups are understandably and necessarily obsessed by their business, their technology, their customer focus and so on. But given the importance of reinsurers why not:

- think of them as your customer?

- ask what can you give them?

- consider whether reinsurance constraints help your business?

Mistake: pretending a blank sheet of paper guarantees success. The “we have no legacy systems” line was tired long ago. Have something positive to say or, better, demonstrate - before launch.

Mistake: projecting unreal volumes. Wishful thinking is no substitute for a costed strategy of how to distribute product. If you are not using intermediaries (advisers or not) or portals (for direct-to-consumer) how will you attract customers’ attention?

Mistake: asking for too much help. You must supply the basic protection expertise, even if you buy it in. Don’t regard reinsurers’ help as free. Accept (as they do) that they don’t know everything e.g. in distributor pricing and quality management. Bring your objective expertise to the table.

Mistake: expecting to match the cheapest in the market. Offer reinsurers a route to good mortality experience, even though you’ve no data initially. Combine this with the low expenses associated with a 21st century launch. De-risk: make sure you can hit the financials before launch.

Mistake: begging a reinsurer not to put rates up. One for incumbents, as the claims come in. You had a joint plan to manage mortality experience? That was implemented? It covered what would happen if things went wrong, even if with robust execution?

If so you should be well placed, with no need to be needy. Despite it being their specialism, you should look to be one step head of your reinsurer on mortality experience!

The DA VINCI code of reinsurance

It’s not all about you. Consider reinsurers’ needs. You can help them - and yourself. Take care when you visit reinsurers. First impressions count and it can be hard to undo damage.

Over 2020 several reinsurers shared with me their appetite to grow their business, and their experiences of when and how things have worked out less well than they’d like.

Reinsurers were explicit about four factors which they use to assess and summarize the attractiveness of a potential client: analytics, volume, innovation and delivery. I have expanded this list to include factors such as domain expertise; while reinsurers were amused, puzzled or even exasperated by this, few explicitly mentioned it in their criteria. Perhaps it was just too obvious?

The reinsurance DA VINCI code

Use this mnemonic to boost your protection business.

- Delivery.

- Analytics.

- Volume.

- Innovation.

- Ninja.

- Control.

- Integrity.

Let’s look at each in turn.

Delivery. The new bottom line – and beyond protection. How speedily and reliability can the client deliver? Will the product be delivered but with disappointing volumes, as enthusiasm dissolves? This might be the most challenging factor, especially where major other elements are lacking. Do you have the determination, drive, discipline and attention to detail to deliver?

Analytics. A data-driven company will probably succeed with underwriting and pricing. Without that mindset it will almost certainly be outsmarted by others. I have used the term analytics rather than machine learning or AI; those tools can certainly add value (e.g. competitor monitoring, predictive underwriting) but so much can be done with a good mental model and simple ratios.

Volume. This cannot be guaranteed, but is important ultimately; few reinsurers have appetite for low volumes and little realistic growth. No guarantees is fine if other factors are good.

Innovation. Reinsurers like being associated with successful innovation. This does not have to be product-related. Instead it could be bringing a new player to market, especially if this involves a sea change c.f. Scottish Provident in the 1990s, Royal Liver and Bright Grey in the 2000s, Vitality in the 2010s. (Based on recent conversation I believe the 2020s may become a golden era.)

Ninja in protection. According to reinsurers, this is often missing. Start-ups led by entrepreneurs can have technology and even funding, but lack the basic ingredient of deep substantive expertise: they don’t know what makes a protection business really succeed. Vague aims to have leading edge systems and to radically put the customer first are no substitute for a hard edge. This is quickly exposed in conversations with reinsurers. Choose your meetings with care.

Control. Distributor analytics gives control and potential competitive advantage, despite the concept being quite mature. Analyzing at the distributor level is the obvious way of monitoring expenses and operations, quality of disclosures, lapse experience, business mix (beyond rating factors) and ultimately actively managing mortality experience. A reinsurer’s dream.

Integrity. Lastly, the most important factor. DA VINCI may be a code, but it’s not a trick. The pressure for sharp practice can be immense, but you should aim for two-way transparent dealings with your reinsurer. Don’t bluff about what you can do in general or for the reinsurer – they are smart enough to see through that. Make your intentions testable and keep your commitments.

Conclusion

Few start-ups are genuinely successful. Those that were had staying power measured in years, not decades. But there’s plenty to aim for and no reason a well-prepared challenger shouldn’t succeed.

1 Reinsurance may not be real magic.