Making the leap in protection

Transformaction divides the individual protection market into leaders, challengers and specialists. Providers in all three segments have scope to progress.

We ask:

- What is the leap? A matter of vision and definition.

- How can you make the leap robustly?

- Who is best placed to help you make the leap?

Spoiler alert: in part 3 I’m going to suggest a consultant can help you deliver.

The leap

Leaders in the individual protection market write £100m of new business annual premiums, each and every year - sometimes significantly more. Specialists generally have a £10m+ inforce income.

The leap from challenger to leader is enormous. The leap from niche player to challenger is perhaps smaller, but certainly doesn’t happen without determination.

Providers in all three segments can make progress:

- Leaders and the top six: optimizing price, underwriting and distribution

- Challengers: improving on the basics (pricing, analytics, underwriting, distribution) and showing the sort of ruthless determination displayed by the likes of L&G and AIG

- Specialists: building their own expertise and a wider protection proposition

Making the leap: three stages

Rather than taking an all or nothing approach, projects should be delivered in stages. In this way additional information emerges naturally and risk is managed. Of particular note is the checkpoint at the end of stage two, where you can consider whether you can really make the leap.

In summary:

| Stage | Content |

| 1: Review status quo |

Establish drivers of volume and profitability Agree channels and products Validate expertise e.g. pricing, reinsurance, underwriting, distribution Match current and future expertise to the above Don't start down the wrong path. Know what you're getting into. |

| 2: Plan to succeed | Build your story for reinsurers: delivery and credibility is king Having obtained their buy in, get reinsurance rates and structures Test your profitability against market premiums and estimate volumes Build a robust go / no-go business case Know your profitability in advance. Costs are limited to consultancy at this point. |

| 3: Deliver at pace | Develop underwriting expertise Design detailed products (largely market standard) Deliver functioning IT Much, much more Stage 3 is where the material costs arise. But they have been factored into the stage 2 business case. |

Our delivering article breaks things down further.

Who should help you make the leap?

How can progress be made? Let’s be specific and consider a challenger who needs to build. Where to source expertise: a consultant or (new or existing) employee?

An existing employee is unlikely to have developed the required expertise, unless that came from elsewhere. In any case, the market moves on.

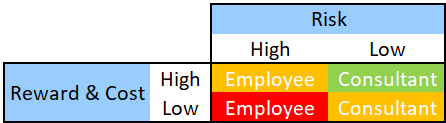

The following table compares consultant and employee, according to whether they are cheap or expensive. My claim is that a consultant with appropriate domain expertise can provide enhanced value and lower risk versus the employee alternative (I’m a consultant of course).

Four choices are set out in the diagram. You can use an employee or consultant and each can be expensive or cheap: I am cutting to the chase! Let’s compare across five dimensions.

Risk. A consultant can make a fast start and can be tested. His contract can be terminated easily.

Cost. A consultant is higher cost, but his expertise and value should emerge within days.

Reward or value. Is there a correlation between what you pay and the reward you can extract? If there is — and there usually is in the rest of life — the decision is not a no-brainer.

Need. Is the project important enough to buy genuine expertise? Is it strategic and even transformational? If so, it may indeed be risky to buy cheaply.

Transition. You can move from consultant to employee, possibly with the same person c.f. McKinsey. Any new face has a framework set up by the tried and tested consultant.

So, where would you find a tried and tested consultant?